Recent reports, including those from CommercialEdge and Goldman Sachs, paint a sobering picture of the CRE landscape for the remainder of 2024. While the office sector has been in the spotlight over the past 18 months, nearly all the different asset classes of commercial real estate properties including multifamily, industrial, retail, hospitality, self-storage, and land are being affected by the higher interest rates. The extend and pretend strategy, while providing temporary relief, may soon reach its rock bottom, threatening to unravel the balance that has so far averted a full-blown crisis.

The issue before all owners of commercial real estate lies in maturing commercial loans, which are now under severe strain due to their composition of short-term, floating rates for properties undergoing transitions of development, renovations, or expansion. This challenge has emerged in the high-stakes arena of commercial real estate (CRE), casting shadows over the $80 billion Collateralized Loan Obligations (CLO) market. This sector, renowned for its sophisticated financial structures, is witnessing an alarming surge in distressed assets with a reported fourfold increase to 7.4% in seven months. The landscape has changed as these CRE CLOs grapple with increasing delinquency rates now breaching into the double-digits. The heightened distress rate, now 480% higher than the previous year, underscores the pressing challenges within this sector.

Despite the predictions of economists who foresaw value destruction totaling $664.1 billion in U.S. office real estate, the anticipated CRE apocalypse has yet to materialize fully. However, this has not dispelled the looming fears and uncertainties in the market. Analysts remain divided, with some predicting severe downturns, while others, like CNBC’s Tim Mullaney, speculate on a commercial real estate crash that “may never happen.” The sector’s resilience is partly attributed to the strategy of “extend and pretend,” where banks and borrowers engage in refinancing or restructuring loans, thus delaying the inevitable reckoning with the economic realities. Yet, the fundamental challenges persist, exacerbated by the dual pressures of declining demand for office space due to the rise of remote work and the daunting task of refinancing amidst soaring interest rates.

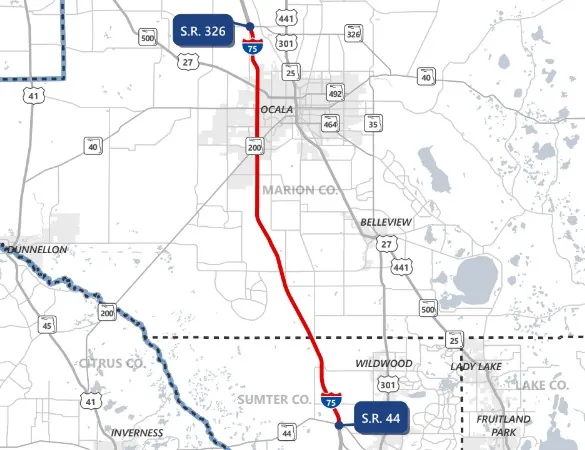

While the rising and falling tides of the economy may raise and sink all boats, it’s important to remember there are vast differences in local and regional markets. Reading headlines about office market collapses in Boston or San Francisco does not mean the Ocala, FL market is reacting in like manner. For this reason, it’s important to be working closely with professionals who are “boots on the ground” and experts in their market. For this reason, SVN McDonald holds an ear to the ground with both Ocala and surrounding markets in order to provide value for our clients.